ezhasil pin number application

To get your income tax number youll need to first register as a taxpayer on e-Daftar. Select the information that you want to update.

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

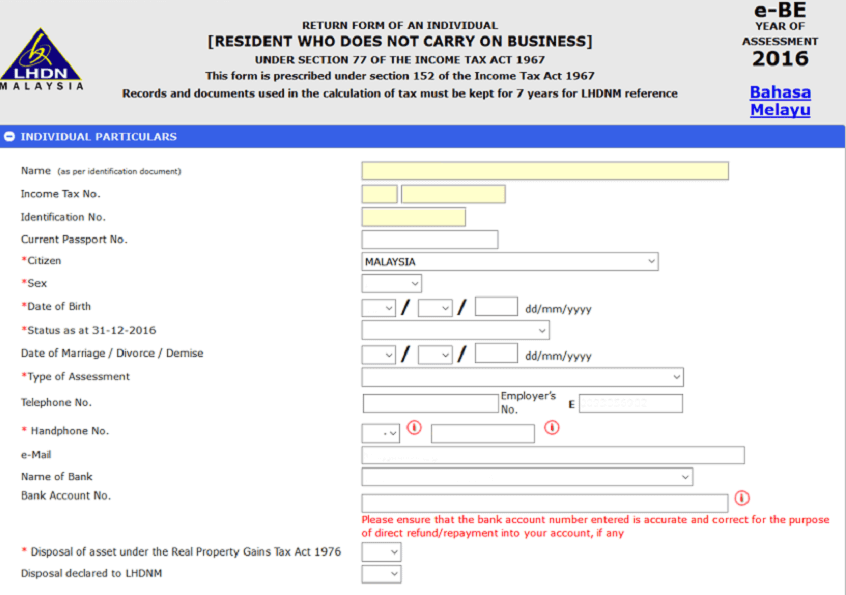

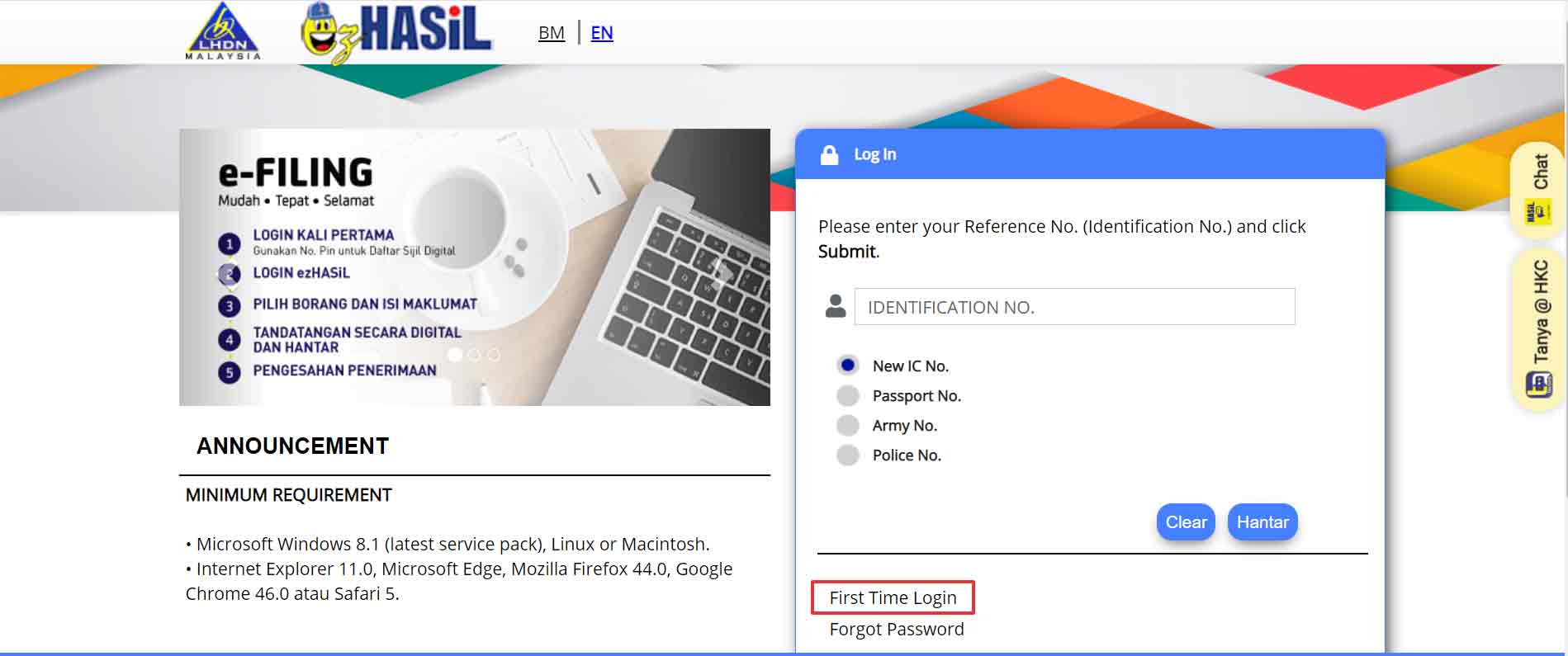

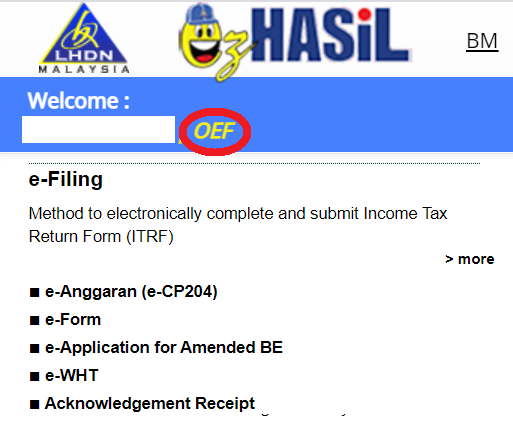

If this is your first time filing your taxes online there are two things that you must have before you can start.

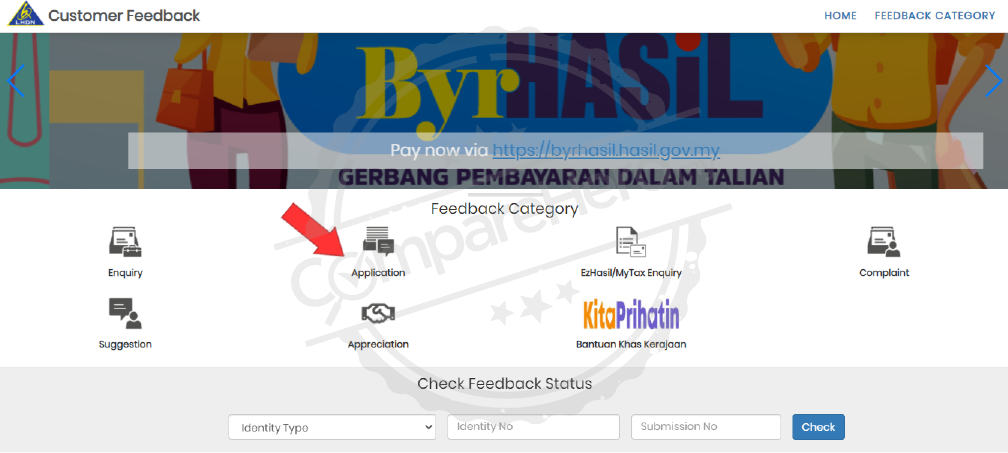

. Click on Application and then e-Filing PIN Number Application at the left menu. Click on Permohonan or Application depending on your chosen language. Go back to the previous page and click on Next.

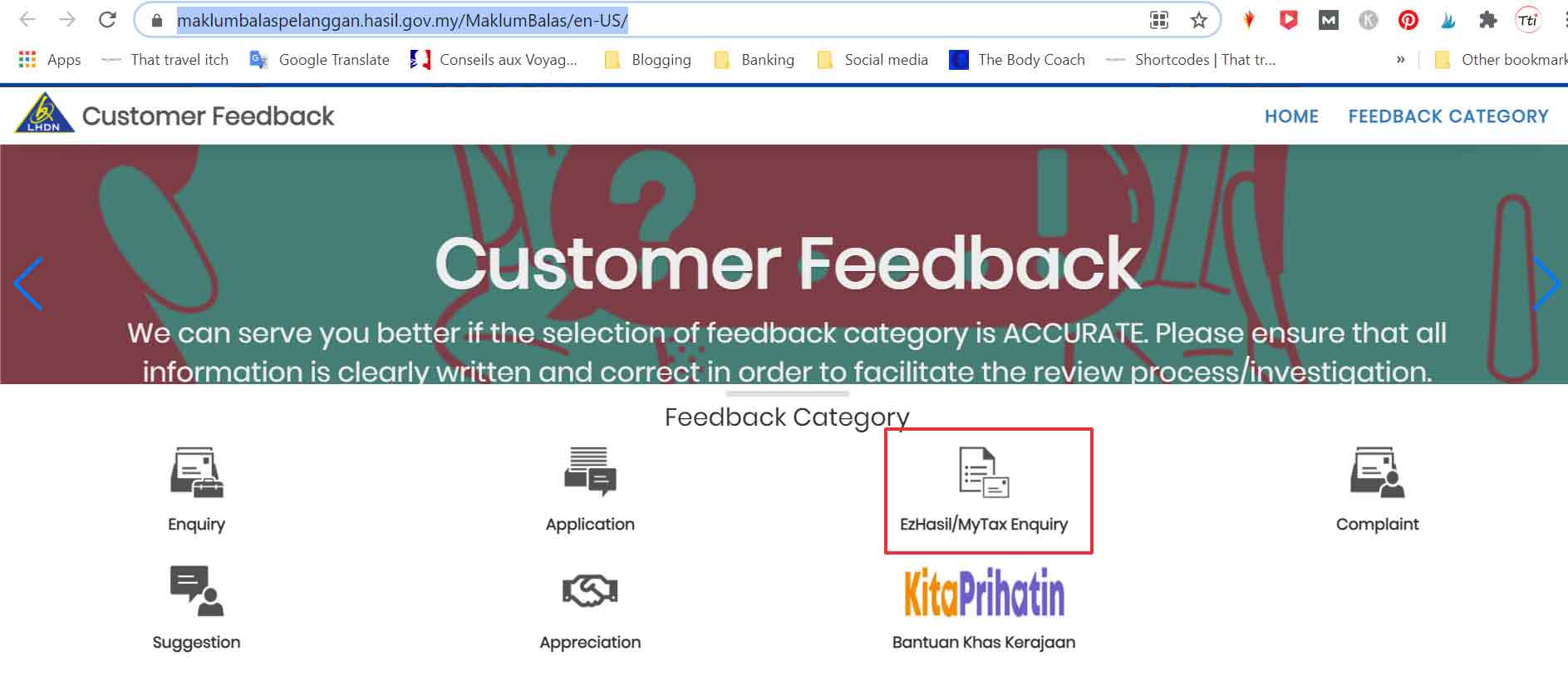

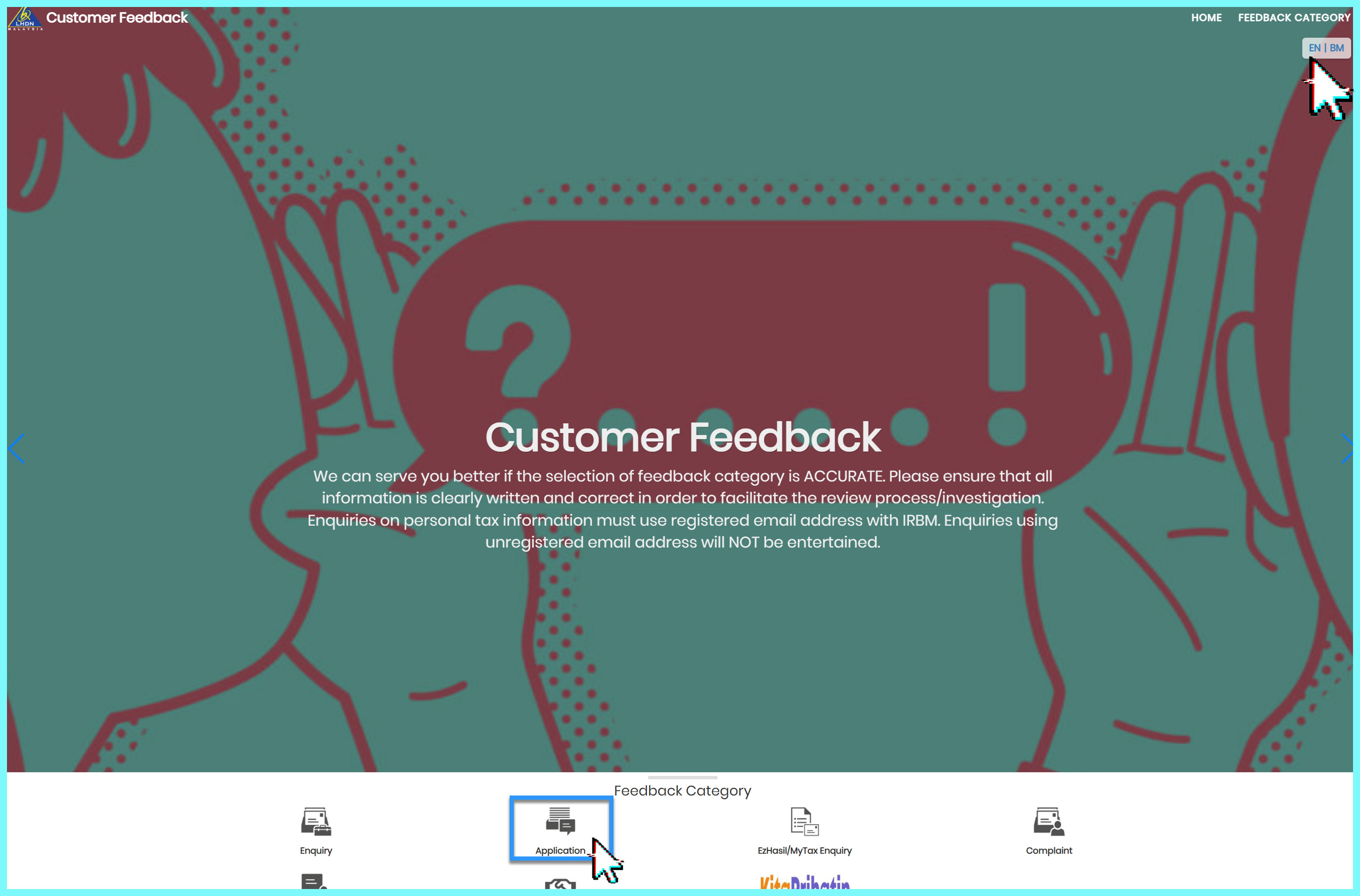

With effect from 1 st July 2022 change of address can only be made through Notification of Change in Address Form CP600B Pin 12022 and accepted either submitted by hand or by post or update online via e-Kemaskini only. Visit ezHASiL and go to the website menu Customer Feedback. Select the Form CP55D and complete the pdf form.

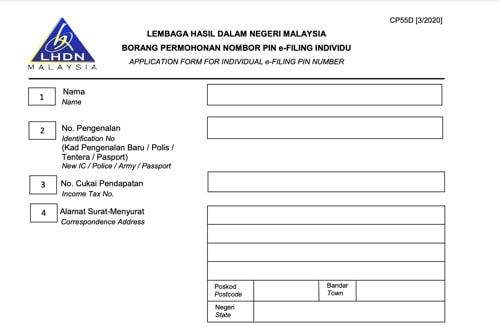

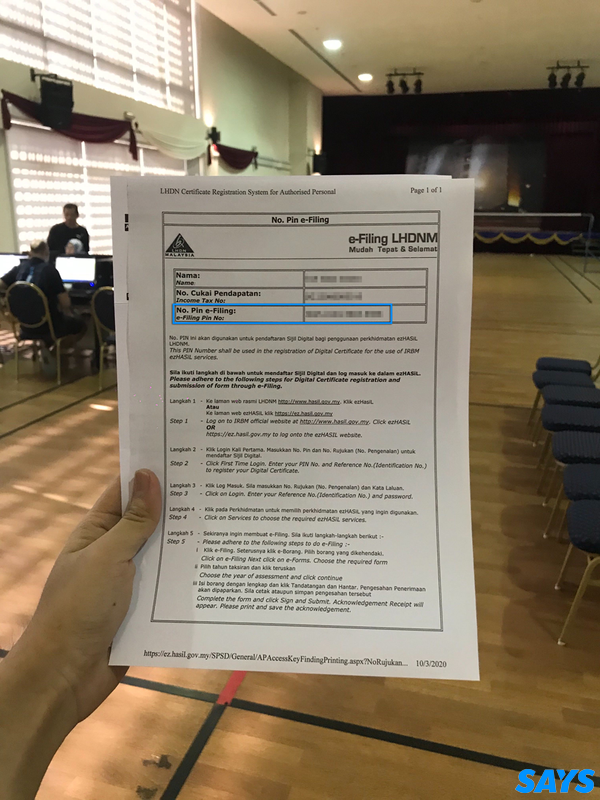

Fill in the form with the required information. Submission via Customer Feedback Form or email is NOT ALLOWED and will not be processed. Bring along your identity card or passport and fill in Form CP55D PIN No.

Heres how you can apply for your PIN number online. Then scan your IC in PDF format. Click EzHasil Services 3.

Apply for PIN Number Login for First Time. Taxpayers who are registered with IRBM and would like to declare income for the first time need to apply e-filing PIN number. Download Form CP55D and fill in the required information.

You may also update below details by using our. A PIN is a unique personal identification number for the purpose of first time login. Click e-Kemaskini 4.

These are the steps to fill up e-Filing online through the ezHASiL portal. Then click on e-Filing PIN Number Application. Effective 2016 online PIN application is no longer available.

Your income tax number and PIN to register for e-Filing the online service to submit your income tax return form ITRF. If you email address not registered with LHDN you have to fill up Online Feedback Form to obtain PIN Number. After your document is successfully uploaded click Next.

Application of organisation e-Filing PIN number can be done by the following ways. If your email address registered with LHDN browse to ezHASiL e-Filing website and click PIN Number Application. Apply for PIN Number.

Click on e-Filing PIN Number Application on the left and then click on Form CP55D. Download a copy of the form and fill in your details. Application Form which can be obtained at the counters.

A PIN can only be obtained at the nearest LHDNM branch or UTC. Scroll to the bottom and click Next. There are 4 methods on how to obtain a PIN Number.

How To Register For Ezhasil E Filing For Individual Malaysia Tax

Pin E Filing Online Mobile Legends

Pin E Filing Online Mobile Legends

How To Request Your Malaysia Tax E Pin Online That Travel Itch

Ezhasil E Filing Login Account Pin Number Digital Certificate Application For Organization The Research Files

How To File Income Tax For The First Time

Ctos Lhdn E Filing Guide For Clueless Employees

Pin E Filing Online Mobile Legends

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Lhdn Login Ezhasil Kali Pertama Cara E Daftar Ehasil 2022

Taxobligations Twitter Search Twitter

How To Request Your Malaysia Tax E Pin Online That Travel Itch

How To File Income Tax For The First Time

How To File Your Taxes For The First Time

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Ezhasil E Filing Login Account Pin Number Digital Certificate Application For Organization The Research Files

Comments

Post a Comment